Why Invest In Liverpool, Merseyside?

Jordan Smethurst • 2021-10-14

Are you looking for a dynamic property market with huge potential for growth? Let me tell you why Liverpool and the Merseyside area should be at the top of your investment list.

Why Invest In Liverpool, Merseyside?

As someone who’s deeply involved in property investment, I can confidently say that if you're considering you’re investment options in the UK, Liverpool and the broader Merseyside area should be at the top of your list. This part of the country is a goldmine. Affordable property prices, solid rental yields, and a growing economy make it a magnet for investors.

With a booming job market, major regeneration projects, and a steady influx of young professionals and students, the city is clearly on an upward trajectory. Let me show you why so many property investors are flocking to Liverpool and how you can take advantage of this growing market…

From a personal perspective, I have been building my own property portfolio throughout Liverpool and surrounding areas over the past few years since 2019. I have seen the value of my properties pretty much double in that period along with market rental figures significantly increasing with no sign of slowing down. The demand for rental property in Liverpool far outweighs the supply of properties meaning that rental prices continue to rise. (9% increase in the past year alone)

Over the years, Liverpool has cemented itself as one of the UK’s top buy-to-let hotspots. Affordable properties, high rental yields and a city that’s been rejuvenating itself make it a goldmine for investors wanting to grow their portfolio.

Why Liverpool should be at the top of your investment list?

- Liverpool is currently the fastest growing economy city in the UK

- (£32 Billion Economy)

- £15 Billion in Re-generation plans on going throughout Liverpool

- The average property price in Liverpool is approximately £170,000, well below the UK average of around £290,000.

- Prices in Liverpool are forecasted to rise by 11.7% by 2027, meaning investing now could result in significant capital growth.

- Low Void Periods– due to high rental demand, Liverpool has some of the lowest vacancy rates in the UK at just 2.1% with properties being let quickly and tenants staying for the long term

- Liverpool has over 70,000 students enrolled across its 4 major universities

- 52,900 Business’ reside in Liverpool, showing strong economic growth

- Home of the Knowledge Quarter, one of the UK’s largest academic and clinical academies

- Former Capital Of Culture winner

- 4th Friendliest Cities in the world ☺

- Liverpool is benefiting from infrastructure projects like the £500 millionexpansion of Liverpool John Lennon Airport, & the Cruise Port Master Plan set to double the amount of visitors annually increasing the city's connectivity and making it more attractive to businesses and residents.

How does Liverpool compare?

Liverpool’s property market has really been on the rise lately, outpacing a lot of other regions in the UK, which is why it’s such an exciting spot for investors right now. We’re seeing annual price growth of around 7-8%, with a five-year increase of 24-28%, and that’s well above the UK average of 5.5%. Compare that to somewhere like London, where growth has slowed to about 2-4%, and it’s clear why people are looking north. Even compared to places like Manchester and Leeds, where prices are growing at 6-8% and 5-7%, Liverpool still offers more affordable opportunities, average house prices here are around £170,000, compared to £250,000 in Manchester and over £500,000 in London. Plus, with regeneration projects booming and demand for housing increasing, it’s expected that Liverpool’s property prices will rise by 11.7% by 2027, making it a solid investment choice.

Best Postcodes to Invest in Liverpool?

Now, your probably wondering, where are the best specific areas in Liverpool for investment?

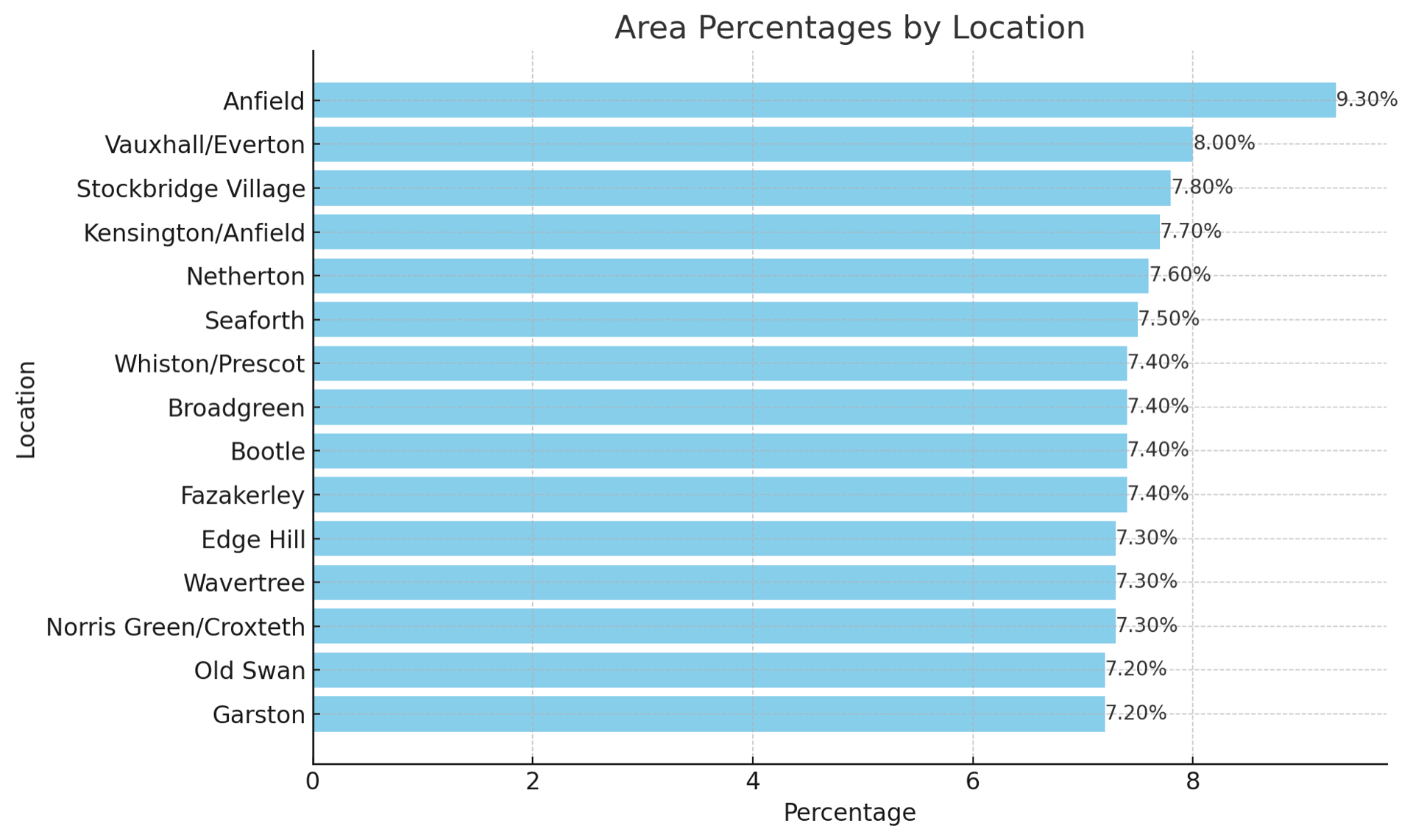

Well, I have created this chart below that will help you determine the areas with the highest rental yields:

It’s clear that Anfield (L4-L6) out performs most other postcodes in Liverpool when it comes down to rental demand and returns and there are some key driving factors that this is down to that we will go into in the next blog – (blog link here)

By now, I hope you feel more informed about why Liverpool is one of the UK’s top investment hot spots. I truly believe it offers a unique opportunity not just for financial gain, but for being part of a city that’s going places.

I’d love to show you personally how you can be part of Liverpool's exciting growth story. Whether you're thinking about your first investment or looking to expand your portfolio, let's talk about what your next steps could look like. Book a call with me, and let’s chat about your vision.

See More Posts

Work with me.

Let's see how we can work together.